Should You Buy Titan Company Shares?

Whether Titan Company shares are a worthy investment in our comprehensive analysis. Weighing in on financial performance, market trends, and future growth potentials. Read now for key insights!

Greetings, Investment enthusiasts!

In the vast landscape of investment opportunities, the glitter of precious metals has always drawn the attention of savvy investors. While gold often steals the spotlight, silver offers a compelling and accessible alternative. Today, with the price of silver at Rs. 99 per gram, it’s an opportune moment to explore why silver could be a smart addition to your investment portfolio. Let’s dive into the reasons why investing in silver makes sense.

Silver presents an affordable entry point into the world of precious metals. At just Rs. 99 per gram, it's much more accessible than gold, allowing individuals to start investing without needing a significant upfront capital. Whether you are a seasoned investor or just starting out, silver offers a practical way to diversify and strengthen your financial position.

Inflation can erode the purchasing power of your money over time. Silver, like other precious metals, acts as a hedge against inflation. Its value tends to hold steady or even increase when the cost of living rises, ensuring that your investment maintains its worth and helps protect your financial future.

Diversification is a cornerstone of a robust investment strategy. Including silver in your portfolio adds a layer of protection against market volatility. Unlike stocks or bonds, silver’s value isn’t directly tied to the performance of financial markets, providing a buffer against potential losses in other areas of your investment portfolio.

Silver is not just a precious metal; it’s also a highly demanded industrial commodity. It’s used extensively in electronics, solar panels, medical devices, and more. This diverse industrial demand supports its price and ensures that silver remains a valuable investment in the long term. As technology continues to advance, the need for silver is likely to grow.

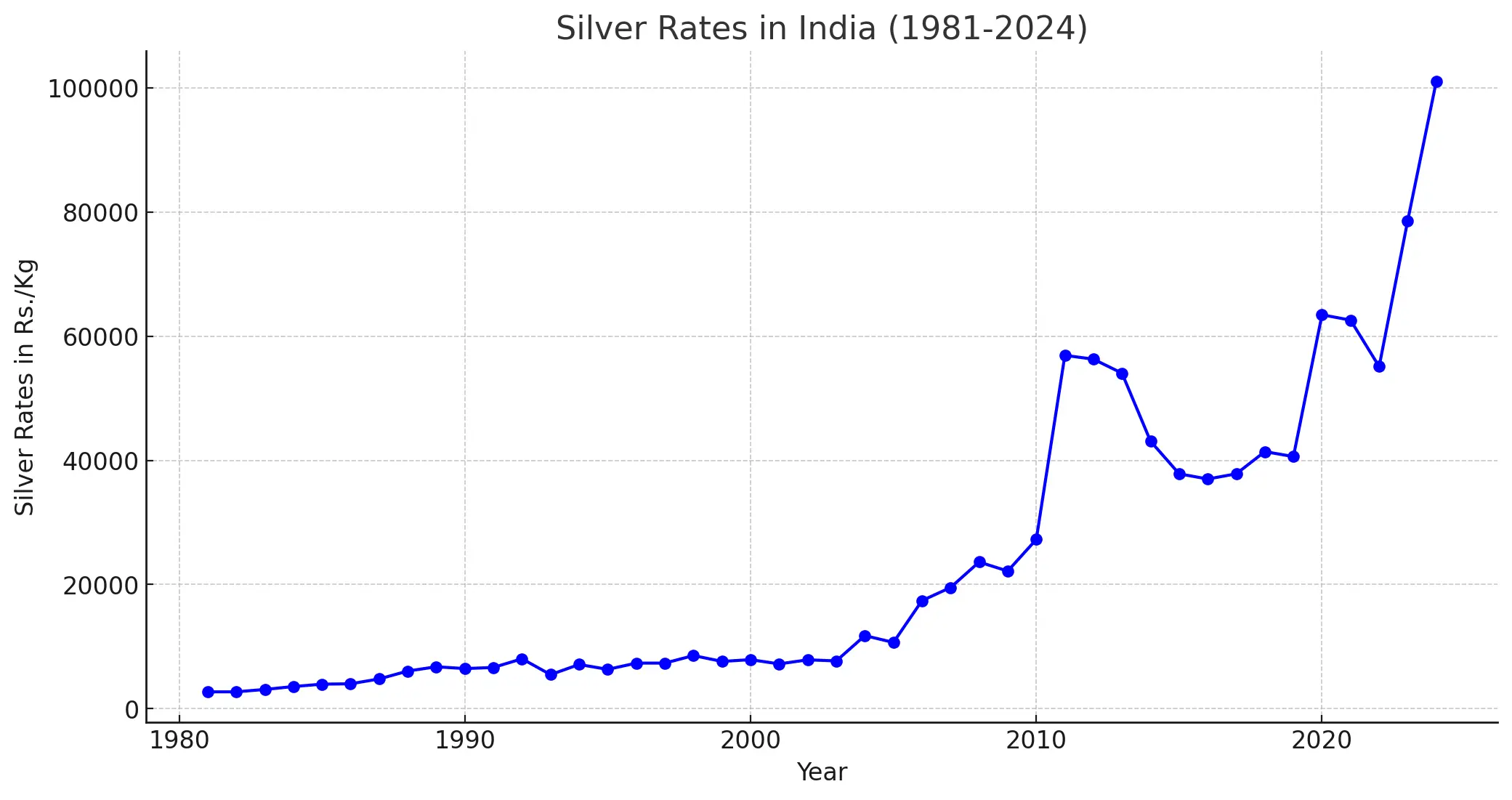

Over the years, silver has shown remarkable resilience and growth. While it may experience short-term fluctuations, its long-term trajectory has been one of appreciation. This makes silver a reliable asset for building and preserving wealth over time.

In India, silver holds a special place in our cultural and traditional practices. From ornate jewelry to auspicious gifts during festivals and weddings, silver is deeply woven into our social fabric. This cultural affinity ensures a steady domestic demand, adding another layer of stability to its value.

Silver is highly liquid, meaning you can easily buy and sell it as needed. This liquidity provides flexibility, allowing you to convert your silver holdings into cash quickly. Moreover, as a tangible asset, silver offers a sense of security and physical ownership, which can be particularly reassuring in uncertain times.

Silver’s price can be more volatile than gold, leading to periods of significant price increases. For investors willing to embrace a bit of risk, this volatility can translate into substantial profits. By buying during market dips and selling during peaks, savvy investors can maximize their returns.

Investing in silver in India is a prudent choice for anyone looking to diversify their portfolio, hedge against inflation, and invest in an asset with both cultural and industrial significance. At just Rs. 99 per gram, silver offers an affordable and potentially profitable investment opportunity.

As you consider your investment options, think about adding silver to your portfolio. It’s a decision that could shine brightly in your financial future.

Whether Titan Company shares are a worthy investment in our comprehensive analysis. Weighing in on financial performance, market trends, and future growth potentials. Read now for key insights!

Dive into Part 2 of our Titan Company Q4FY24 earnings analysis. Discover how different business segments performed and what the future holds for investors. Read now for detailed insights!

Explore our detailed analysis of Titan Company's Q4FY24 earnings report, including key financial metrics and market insights. Learn what Titan's latest financial results mean for investors.